Definition

SWOT analysis involves the collection and portrayal of information about internal and external factors that have, or may have, an impact on business.[2]

SWOT is a framework that allows managers to synthesize insights obtained from an internal analysis of the company’s strengths and weaknesses with those from an analysis of external opportunities and threats.[3]

What is SWOT Analysis

What is SWOT analysis? The answer to the question is simple: it’s a tool used for situation (business or personal) analysis! SWOT is an acronym that stands for:

Strengths: factors that give the company an edge over its competitors.

Weaknesses: factors that can be harmful if used against the firm by its competitors.

Opportunities: favorable situations which can bring a competitive advantage.

Threats: unfavorable situations that can negatively affect the business.

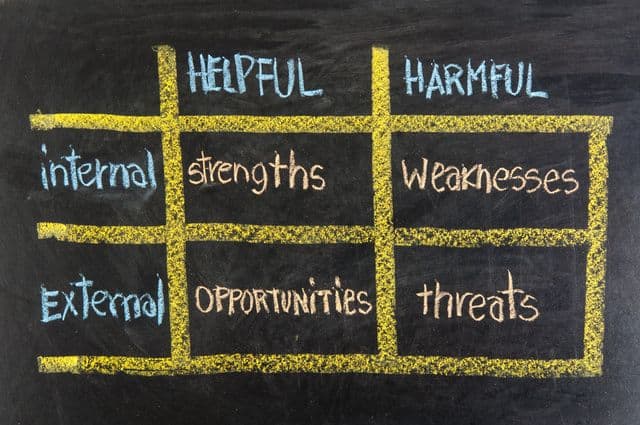

Strengths and weaknesses are internal to the company and can be directly managed by it, while the opportunities and threats are external and the company can only anticipate and react to them. Often, SWOT is presented in a form of a matrix as in the illustration below:

SWOT is a widely accepted tool due to its simplicity and value of focusing on the key issues which affect the firm. The aim of SWOT is to identify the strengths and weaknesses that are relevant in meeting opportunities and threats in particular situation. [4]

Benefits

SWOT tool has 5 key benefits:

- Simple to do and practical to use.

- Clear to understand.

- Focuses on the key internal and external factors affecting the company.

- Helps to identify future goals.

- Initiates further analysis.

Limitations

Although there are clear benefits of doing the analysis, many managers and academics heavily criticize or don’t even recognize it as a serious tool.[2] According to many, it is a ‘low-grade’ analysis. Here are the main flaws identified by the research:[2][5]

- Excessive lists of strengths, weaknesses, opportunities and threats.

- No prioritization of factors.

- Factors are described too broadly.

- Factors are often opinions, not facts.

- No recognized method to distinguish between strengths and weaknesses, opportunities and threats.

How to perform the analysis?

SWOT can be done by one person or a group of members who are directly responsible for the situation assessment in the company. Basic SWOT analysis is done fairly easily and comprises of only a few steps:

Step 1. Listing the firm’s key strengths and weaknesses

Step 2. Identifying opportunities and threats

Strengths and Weaknesses

Strengths and weaknesses are the factors of the firm’s internal environment. When looking for strengths, ask what you do better or have more valuable than your competitors have. In case of the weaknesses, ask what you could improve and at least catch up with your competitors?

Where to look for them?

Some strengths or weaknesses can be recognized instantly without deeper studying of the organization. But usually, the process is harder and managers have to look into the firm’s:

- Resources: land, equipment, knowledge, brand equity, intellectual property, etc.

- Core competencies

- Capabilities

- Functional areas: management, operations, marketing, finances, human resources and R&D

- Organizational culture

- Value chain activities

Strength or a weakness?

Often, a company’s internal factors are seen as both strengths and weaknesses at the same time. It is also hard to tell if a characteristic is a strength (weakness) or not. For example, a firm’s organizational structure can be a strength, a weakness or neither! In such cases, you should rely on:

Clear definition. Very often, factors that are described too broadly may fit both strengths and weaknesses. For example, “brand image” might be a weakness if the company has a poor brand image. However, it can also be a strength if the company has the most valuable brand in the market, valued at $100 billion. Therefore, it is easier to identify if a factor is a strength or a weakness when it’s defined precisely.

Benchmarking. The key emphasis in doing SWOT is to identify the factors that are the strengths or weaknesses in comparison to the competitors. For example, a 17% profit margin would be an excellent margin for many firms in most industries, and it would be considered as a strength. But what if the average profit margin of your competitors is 20%? Then company’s 17% profit margin would be considered as a weakness.

VRIO framework. A resource can be seen as a strength if it exhibits VRIO (valuable, rare and cannot be imitated) framework characteristics. Otherwise, it doesn’t provide any strategic advantage for the company.

Opportunities and threats

Opportunities and threats are the external uncontrollable factors that usually appear or arise due to the changes in the macro environment, industry or competitors’ actions. Opportunities represent the external situations that bring a competitive advantage if seized upon. Threats may damage your company so you would better avoid or defend against them.

Where to look for them?

PESTEL. PEST or PESTEL analysis represents all the major external forces (political, economic, social, technological, environmental and legal) affecting the company so it’s the best place to look for existing or new opportunities and threats.

Competition. Competitors react to your moves and external changes. They also change their existing strategies or introduce new ones. Therefore, the company must always follow the actions of its competitors as new opportunities and threats may open at any time.

Market changes. The most visible opportunities and threats appear during the market changes. Markets converge, starting to satisfy other market segment needs with the same product. New geographical markets open up, allowing the firm to increase its export volumes or start operations in a new country. Often niche markets become profitable due to technological changes. As a result, changes in the market create new opportunities and threats that must be seized upon or dealt with if the company wants to gain and sustain a competitive advantage.

Opportunity or threat?

Most external changes can represent both opportunities and threats. For example, exchange rates may increase or reduce the profits gained from exports. This depends on the exchange rate, which may rise (opportunity) or fall (threat) against the home country’s currency. The organization can only guess the outcome of the change and count on analysts’ forecasts. In such cases, when an organization cannot identify if the external factor will affect it positively or negatively, it should gather unbiased and reliable information from external sources and make the best possible judgment.

Guidelines for successful SWOT

The following guidelines are very important in writing a successful SWOT analysis. They eliminate most of the SWOT limitations and improve it’s results significantly:

- Factors have to be identified relative to the competitors. It allows specifying whether the factor is a strength or a weakness.

- List between 3 – 5 items for each category. Prevents creating too short or endless lists.

- Items must be clearly defined and as specific as possible. For example, firm’s strength is: brand image (vague); strong brand image (more precise); brand image valued at $10 billion, which is the most valued brand in the market (very good).

- Rely on facts, not opinions. Find some external information or involve someone who could provide an unbiased opinion.

- Factors should be action-orientated. For example, “slow introduction of new products” is action orientated weakness.

SWOT analysis example A

This is a basic example of the analysis:

| Strengths | Weaknesses |

|---|---|

| 1. Second most valuable brand in the world, valued at $76 billion 2. Diversified income (5 different brands earning more than $4 billion each) 3. Strong patents portfolio (15,000 patents) 4. Investments in R&D reaching 4 billion a year. 5. Competent in mergers & acquisitions 6. Have access to cheap cash reserves 7. Effective corporate social responsibility (CSR) projects 8. Localized products 9. Highly skilled workforce 10. Economies of scale or economies of scope | 1. Investments in R&D are below the industry average 2. Very low or zero profit margins 3. Poor customer services 4. High employee turnover 5. High cost structure 6. Weak brand portfolio 7. Rigid (bureaucratic) organizational culture impeding fast introduction of new products 8. High debt level ($3 billion) 9. Brand dilution (the firm has too many brands) 10 Poor presence in the world’s largest markets |

| Opportunities | Threats |

|---|---|

| 1. Market growth for the main firm’s product 2. Growing demand for renewable energy 3. New technology that would drive production costs by 20% is in development 4. Our country’s accession to EU 5. Changing customer habits 6. Disposable income level will increase 7. Government’s incentives for ‘specific’ industry 8. The economy is expected to grow by 4% next year 9 Growing number of people buying online 10. Interest rates falling to 1% | 1. Corporate tax may increase from 20% to 22% in 2013 2. Rising pay levels 3. Rising raw material prices 4. Intense competition 5. The market is expected to grow by only 1% next year, indicating market saturation 6. Increasing fuel prices 7. Aging population 8. Stricter laws regulating environmental pollution 9. Lawsuits against the company 10. Currency fluctuations |

You can find an extensive list of strengths, weaknesses, opportunities and threats by looking at our examples of SWOT analyses, which include Alphabet (Google) SWOT, Amazon.com SWOT, Apple Inc. SWOT, The Coca Cola Company SWOT, Ford Motor Company SWOT, McDonald’s Corporation SWOT, PepsiCo Inc. SWOT, Samsung Electronics SWOT, Starbucks Corporation SWOT, Walmart Stores, Inc. SWOT and many more swot analyses.

Advanced SWOT

At the most, SWOT is considered to be only a reference to further analysis as it has too many limitations and cannot be used alone in the situation analysis. The previous guidelines identified in this article meet most of the SWOT limitations except one: “prioritization of factors”. An advanced SWOT goes a step further and eliminates this important drawback.

In a simple SWOT, strengths and weaknesses or opportunities and threats are equal to each other. Therefore a minor weakness can balance a major strength. Without prioritization, some factors might be given too much or too little emphasis and the most relevant factors might simply be overlooked.

The aim of advanced SWOT is to identify the most significant factors of the analysis from all the items listed in it. How to perform it?

Step 1. Identify strengths, weaknesses, opportunities and threats.

Step 2. Prioritize them.

(The first step was discussed earlier so please refer to it when doing an advanced SWOT analysis. See example B when reading further instructions.)

Prioritization

Strengths and weaknesses are evaluated on three categories:

- Importance. Importance shows how important a strength or a weakness is for the organization in its industry as some strengths (weaknesses) might be more important than others. A number from 0.01 (not important) to 1.0 (very important) should be assigned to each strength and weakness. The sum of all weights should equal 1.0 (including strengths and weaknesses).

- Rating. A score from 1 to 3 is given to each factor to indicate whether it is a major (3) or a minor (1) strength for the company. The same rating should be assigned to the weaknesses where 1 would mean a minor weakness and 3 a major weakness.

- Score. Score is a result of importance multiplied by rating. It allows for prioritizing the strengths and weaknesses. You should rely on your most important strengths and try to convert or defend your weakest parts of the organization.

Opportunities and threats are prioritized slightly differently than strengths and weaknesses. Their evaluation includes:

- Importance. It shows to what extent the external factor might impact the business. Again, the numbers from 0.01 (no impact) to 1.0 (very high impact) should be assigned to each item. The sum of all weights should equal 1.0 (including opportunities and threats).

- Probability. The probability of occurrence shows how likely the opportunity or threat will have any impact on business. It should be rated from 1 (low probability) to 3 (high probability).

- Score. Importance multiplied by probability will give a score by which you’ll be able to prioritize opportunities and threats. Pay attention to the factors having the highest score and ignore the factors that will not likely affect your business.

SWOT analysis example B

This SWOT example is adopted from the previous example and additionally includes prioritization. Highlighted cells point to the most significant factors affecting the organization.

Advanced SWOT of Company X

| Strengths | Importance | Rating | Score |

|---|---|---|---|

| Second most valuable brand in the world | 0.03 | 1 | 0.03 |

| Diversified income | 0.01 | 2 | 0.02 |

| Strong patents portfolio (15,000 patents) | 0.15 | 3 | 0.45 |

| Investments in R&D reaching 4 billion a year | 0.10 | 2 | 0.20 |

| Competent in mergers & acquisitions | 0.05 | 3 | 0.15 |

| An access to cheap cash reserves | 0.02 | 1 | 0.02 |

| Effective corporate social responsibility (CSR) projects | 0.03 | 1 | 0.03 |

| Localized products | 0.01 | 1 | 0.01 |

| Highly skilled workforce | 0.08 | 2 | 0.16 |

| Economies of scale/economies of scope | 0.02 | 3 | 0.06 |

| Weaknesses | Importance | Rating | Score |

|---|---|---|---|

| Investments in R&D are below the industry average | 0.03 | 2 | 0.06 |

| Very low or zero profit margins | 0.08 | 2 | 0.24 |

| Poor customer services | 0.10 | 2 | 0.20 |

| High employee turnover | 0.05 | 2 | 0.10 |

| High cost structure | 0.03 | 3 | 0.09 |

| Weak brand portfolio | 0.02 | 1 | 0.02 |

| Bureaucratic organizational culture | 0.03 | 1 | 0.03 |

| High debt level ($3 billion) | 0.03 | 1 | 0.03 |

| Brand dilution (the firm has too many brands) | 0.01 | 1 | 0.01 |

| Poor presence in the world’s largest markets | 0.12 | 2 | 0.24 |

| Opportunities | Importance | Probability | Score |

|---|---|---|---|

| Market growth for the main business product | 0.10 | 2 | 0.20 |

| Growing demand for renewable energy | 0.01 | 1 | 0.01 |

| New technology is in development | 0.13 | 1 | 0.13 |

| Our country accession to EU | 0.05 | 3 | 0.15 |

| Changing customer habits | 0.05 | 1 | 0.05 |

| Disposable income level will increase | 0.02 | 3 | 0.06 |

| Government’s incentives for ‘specific’ industry | 0.03 | 2 | 0.06 |

| Economy is expected to grow by 4% next year | 0.01 | 2 | 0.02 |

| Growing number of people buying online | 0.08 | 3 | 0.24 |

| Interest rates falling to 1% | 0.02 | 3 | 0.06 |

| Threats | Importance | Probability | Score |

|---|---|---|---|

| Corporate tax may increase from 20% to 22% in 2024 | 0.12 | 2 | 0.24 |

| Rising pay levels | 0.03 | 2 | 0.06 |

| Rising raw material prices | 0.09 | 3 | 0.27 |

| Intense competition | 0.07 | 1 | 0.07 |

| Market is expected to grow by only 1% next year | 0.05 | 3 | 0.15 |

| Increasing fuel prices | 0.01 | 3 | 0.03 |

| Aging population | 0.01 | 3 | 0.03 |

| Stricter laws regulating environment pollution | 0.01 | 1 | 0.01 |

| Lawsuits against the company | 0.02 | 1 | 0.02 |

| Currency fluctuations | 0.09 | 2 | 0.18 |

Sources

- Thompson, J. and Martin, F. (2010). Strategic Management: Awareness & Change. 6th ed. Cengage Learning EMEA, p. 140, 817

- Pickton, D.W. and Wright, S. (1998). What’s SWOT in strategic analysis? Strategic Change Vol. 7, pp. 101-109, 105-106

- Rothaermel, F. T. (2012). Strategic Management: Concepts and Cases. McGraw-Hill/Irwin, p. 105-106

- Johnson, G, Scholes, K. Whittington, R. (2008). Exploring Corporate Strategy. 8th ed. FT Prentice Hall, p. 156, 160

- Coman, A. and Ronen, B. (2009). Focused SWOT: diagnosing critical strengths and weaknesses. International Journal of Production Research Vol. 40, Issues 20, pp. 5677–5689

- Kotler, P. (1991). Marketing Management. 7th ed. Prentice-Hall

- David, F.R. (2009). Strategic Management: Concepts and Cases. 12th ed. FT Prentice Hall, p. 125-126, 166-168

- Virtual Strategist (2008). SWOT analysis: How to perform one for your organization (VIDEO). Available at: https://www.youtube.com/watch?v=GNXYI10Po6A

- Wikipedia (2013). SWOT analysis. Available at: https://en.wikipedia.org/wiki/SWOT_analysis