What is a Go-To-Market Strategy

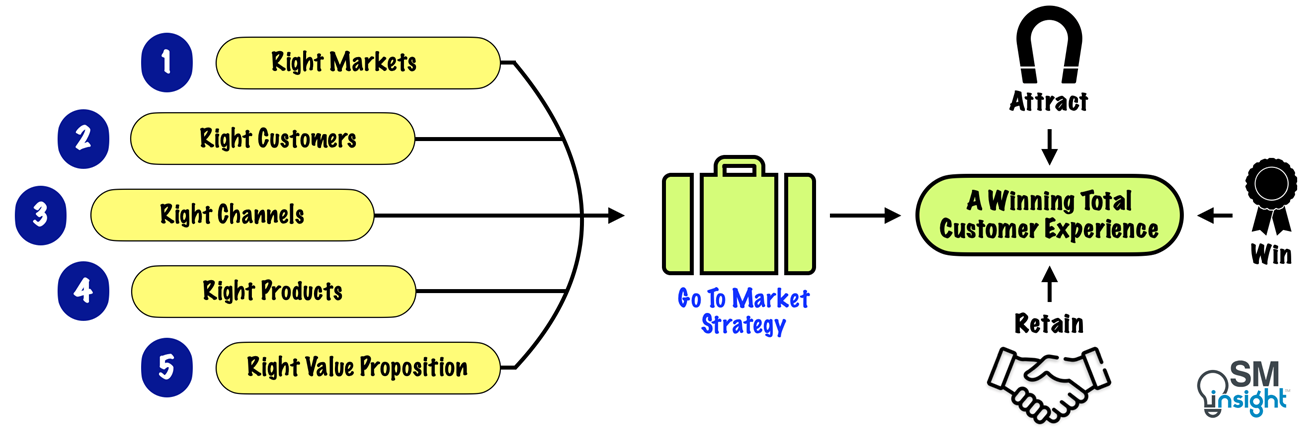

Go-To-Market Strategy (GTM strategy) is a game plan for reaching and serving the right customers in the right markets, through the right channels, with the right products and the right value proposition.

Its purpose is to create a powerful, winning total customer experience that will attract, win, and retain the most desirable customers while driving high sales and market share growth at the lowest possible cost.

So, what is winning total customer experience?

Customer relationships are shaped by numerous interactions called ‘touch points’ that begin with brand awareness and continue through the first contact, pre-sales activities, the first purchase, installation, customer support, service, ongoing purchases, and long-term care.

At each interaction, customers undergo experiences that can range from excellent to dreadful, ultimately shaping a company’s image and its potential for long-term growth.

A winning Total Customer Experience requires every customer interaction to be positive, consistent, high quality, and memorable, whether the customer is buying something, seeking information, meeting face to face, or looking at a Web site.

Such a Customer Experience is the goal of a GTM Strategy.

A GTM strategy has five focus areas: Markets, Customers, Channels, Products, and Value Propositions.

When all of these come together in one coherent and coordinated system, businesses witness accelerated revenue growth, decreased selling costs & happier, more loyal customers.

Choosing the right Markets

The choice of market influences every other GTM strategy decision that a company makes. For example, It is impossible to choose a successful mix of channels until it is determined

which markets those channels are supposed to reach.

A good market is one in which customers are highly receptive to a business’s message and offerings. In such a market, the business is able to sell the highest possible volume to the most possible customers at the lowest possible cost.

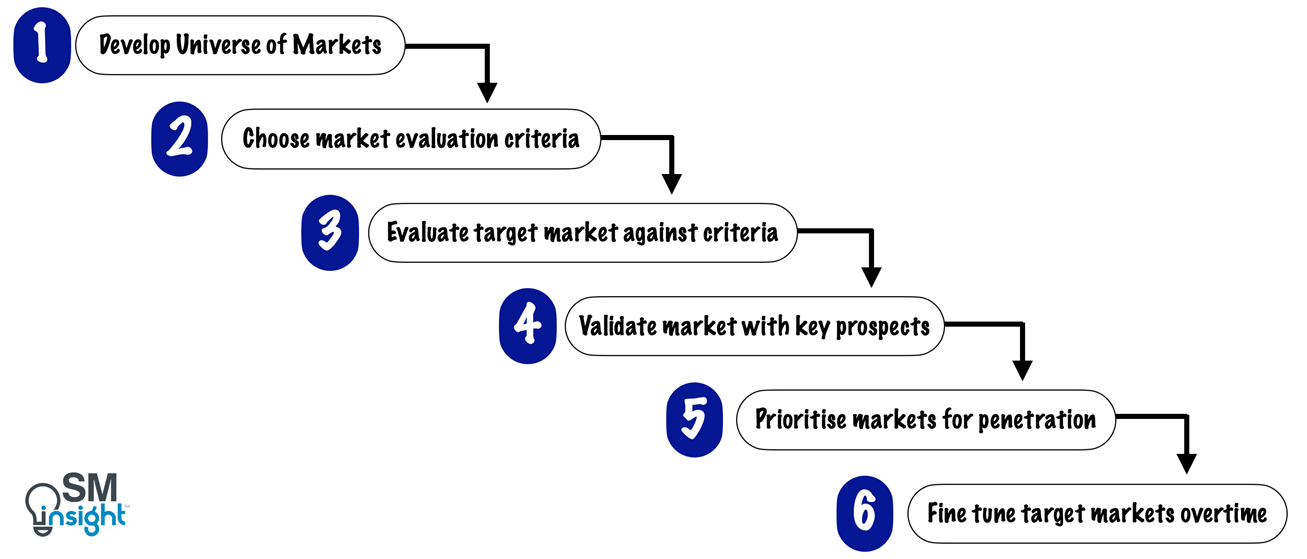

Companies must strive to pinpoint the specific markets and segments in which their value propositions will be strongest and best received. A six-step process for targeting and choosing ideal markets is as shown:

1. Develop a universe of market

A business must cast a wide net for new market opportunities to uncover potential markets and segments in which it could realistically participate.

Such a process can begin by generating a list of potential new markets based on what a business already knows or believes about market conditions. Inputs from customer-facing roles within the company are a great source of key insights.

A basic filter must then be applied to exclude markets that have prohibitive entry costs, legal/regulatory restrictions or no demand for the products or services on offer.

What remains is a list of plausible markets which can then be divided into discrete, smaller sub-markets or segments to target more effectively and precisely.

While choosing markets in this stage, it is important to avoid the ‘rush to judgment’ or the pressure to show immediate sales results.

2. Choose market evaluation criteria

The purpose of evaluation criteria is to establish consistency that can be applied across all markets to evaluate and compare in a uniform manner.

Some of the useful and more common evaluation criteria include:

| Market size | The total dollar volume that will be spent in a market |

| Market growth rate | Expected growth in purchasing volume |

| Ability to exert brand leadership | How well is the company positioned for long-term brand building and growth |

| Cost of market entry | Entry costs for markets that made it through the initial screening |

| Cost to serve | Cost to serve customers in the target market. Also indicates how profitable the markets can be. |

| Channel availability | Are there existing channels available? Can new channels be built with relative ease to serve customers? |

| Competitive density | Concentration of competitors within a market |

| Strategic Fit | The long-term, strategic value of the market to a company, particularly in relation to other markets in which it is willing to participate |

Depending on the business, some of the criteria can be more important than others.

The table as shown below can be prepared to serve as a starting point for choosing market selection criteria:

| Business goal | Selection Criteria | |||||||

| Market size | Market growth rate | Ability to exert brand leadership | Cost of market entry | Cost to serve | Channel availability | Competitive density | Strategic fit | |

| Long-term growth in revenue and mkt. share | ✔✔ | ✔ | ✔ | ✔ | ✔✔ | ✔ | ||

| Profitability | ✔✔ | ✔✔ | ✔ | ✔✔ | ||||

| Brand building | ✔ | ✔ | ✔✔ | ✔ | ✔✔ | |||

| ‘Quick hit’ (short-term win) | ✔ | ✔ | ✔✔ | ✔ | ||||

| ✔✔: Very Important ✔: Important | ||||||||

These criteria can be further classified into ‘Core’ and ‘Secondary’ before moving on to the evaluation of markets against those criteria.

3. Evaluate target markets against criteria

The purpose of this step is to use the market evaluation criteria to assess, compare and rate each of the potential new markets against each other.

The below table provides an example of an evaluation of three new markets: Fortune 500, Small and Medium Business (SMB), and High technology:

| Market Evaluation Criteria | Fortune 500 | SMB | High Tech Vertical | |

|---|---|---|---|---|

| Core Criteria | Market Size | ✔✔✔ | ✔✔ | ✔✔ |

| Market Growth Rate | ✔✔ | ✔✔✔ | Not Known | |

| Channel Availability | ✔✔✔ | ✔✔ | ✔✔ | |

| Secondary Criteria | Competitive Density | ✔ | ✔✔ | ✔ |

| Cost to Serve | ✔✔✔ | ✔ | ✔✔ | |

| International Growth Potential | ✔✔✔ | ✔ | ✔✔ | |

| Overall Assessment | ✔✔✔ | ✔✔ | ✔✔ | |

| ✔✔✔: Very Favorable ✔✔: Favorable ✔: Marginal/Poor | ||||

To acquire information needed to evaluate a market, businesses will have to depend on various sources such as published research reports, consultants’ studies, internal sources of information such as sales reps, customer surveys of target markets, analyses of competitors, partner interviews and so on.

The outcome of this step is a shortlist of five to ten markets and segments that fully or mostly meet the conditions for selection.

4. Validate markets with key prospects

This step involves performing a final vetting of the best potential market to ensure that the targeted customers will actually purchase the product/service.

Validation can vary in rigor.

For instance, some businesses may conduct 100-200 interviews with key prospects per potential market to confirm demand while some might contact only a few prospects. It is crucial to uncover any overestimated customer demand and interest in this step before a company invests heavily in market penetration.

The outcome of this step is a small group of attractive target markets that meet the conditions of selection and have been vetted for customer receptivity and demand.

5. Prioritize markets for penetration

Due to resource limitations, not all markets can be chased simultaneously. Businesses can use two approaches to select what markets to focus on:

- Choose the market(s) that ranked highest when evaluated against the criteria chosen earlier.

- Choose based on conditions that relate to the time and investment requirements needed to penetrate a market. This is based on the view that the best markets to pursue are those that offer immediate sales opportunities and can be reached with existing channels and partners, low start-up costs and few market entry hassles.

6. Fine-tune markets over time

Market conditions change over time. A great market may turn into a disaster or the one that didn’t seem to offer much opportunity may witness exponential growth.

Hence, businesses need to continually keep track of where opportunities lie. Market targeting is a continual ‘fine-tuning’ process and must be repeated once a year to ensure that a business can respond to new opportunities.

Aligning with the right Customers

Having a good understanding of markets but a superficial understanding of customers leads to a failed strategy for a simple reason – markets don’t buy things, customers do.

Most failed products, channels and marketing initiatives have one thing in common: they fail to consider the needs and actual buying behaviors of customers and prospects.

The success of every go-to-market decision a business makes, and indeed its ability to make those decisions, depends on how well the business understands its customers.

A GTM strategy must clearly articulate who the customers are, what they buy, why they buy, how they buy, how they want to buy it, and what would motivate them to buy more.

Companies align poorly with their customers due to two kinds of traps:

The ‘no research’ trap

These companies do absolutely no research on their customers’ needs and behaviors.

Segway[2] is a classic example. Designed to be a revolutionary means of transportation, the Segway was a two-wheeled, self-balancing personal transporter brought to the market in 2001 at a launch price of $5,000.

Even though the product was revolutionary, its creators failed to see the difference between practicality and blue-sky thinking. City infrastructure and safety were not addressed before going to the market.

The basic question of why a customer would invest $ 5,000 in transportation that couldn’t be used on city roads was left unanswered. Today, Segway ranks alongside New Coke, the Apple Newton and Google Glass as one of the greatest product flops in history.[3]

The ‘useless research’ trap

Another common problem lies with companies that do a lot of research but still, fail to understand little or nothing about the drivers of their customers’ purchasing decisions.

In 2008, after extensive market research, Tata launched Nano[4] a brilliant, cheap little car targeted at the middle-class and lower-middle-class sector. The car was positioned and marketed as a “One Lakh Rupees Car” (about $2500 at the time) with its ‘cheap’ price as the USP.

However, among many reasons for Nano’s failure, the primary one was this very marketing strategy that grossly misunderstood what customers value. In India, a car is seen more as a status symbol than a utility. By branding Nano as a “cheap car”, Tata killed the entitlement that was supposed to come with it, and customers did not find it worth buying.

Learning about customers

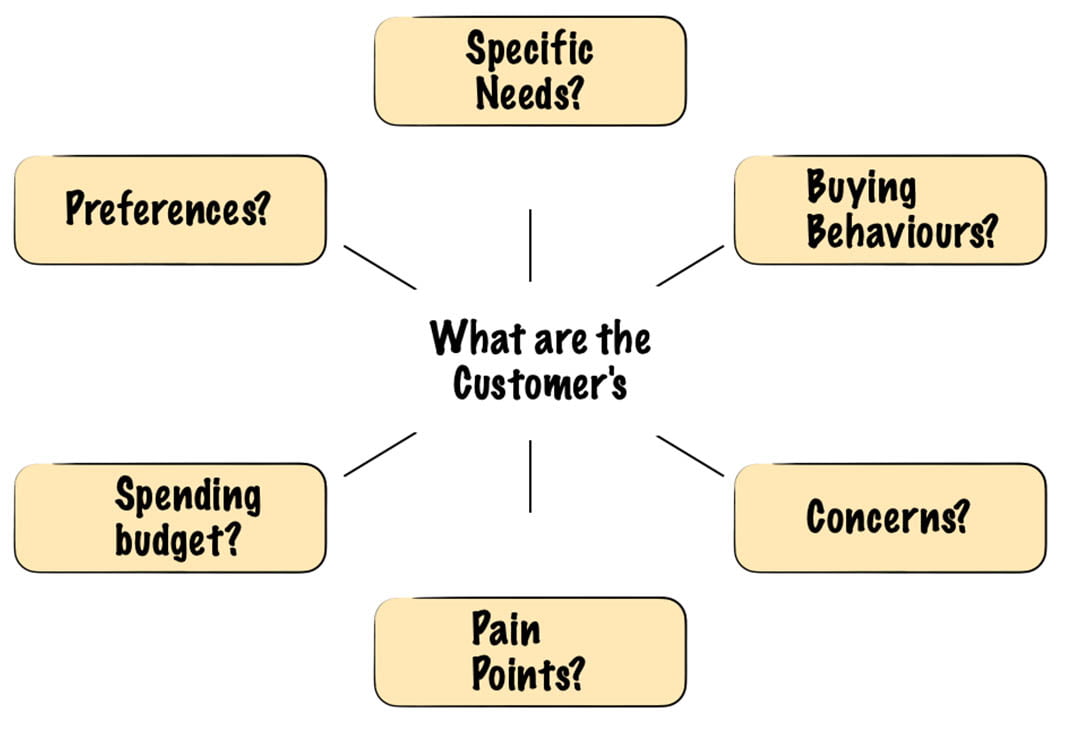

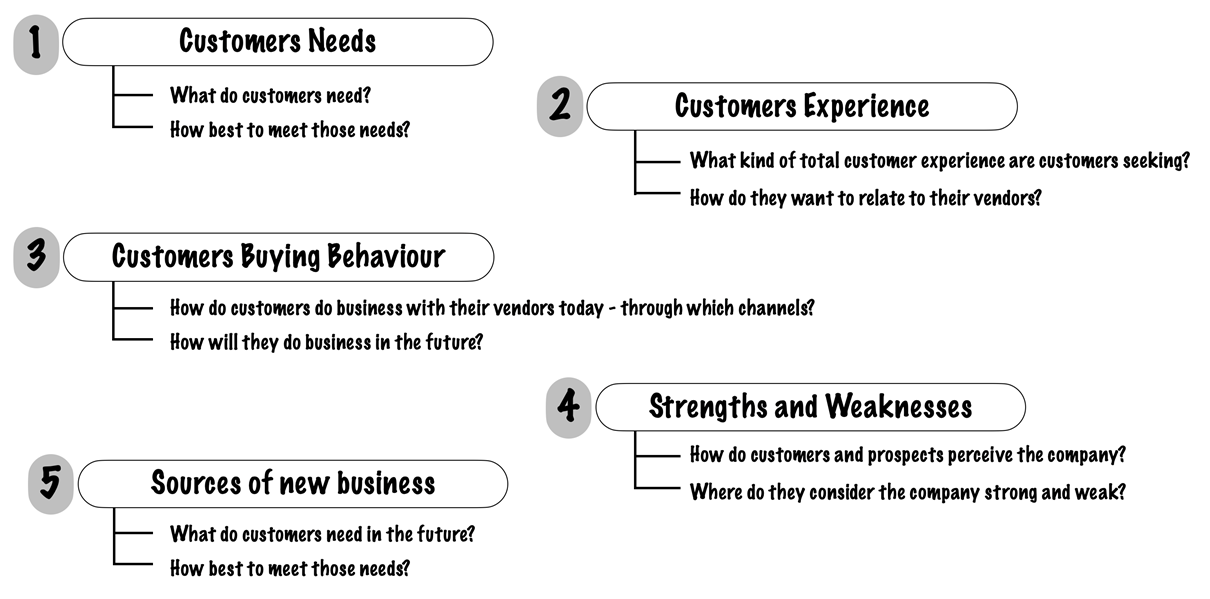

Businesses must look at five key types of customer information that directly impact their GTM decision-making:

1. Customers’ needs

For any business, the fundamental needs of its target customers will impact the choice and design of products and services, messaging, promotion strategies, sales pitch, choice of sales channels, and the nature and extent of post-sale support and service.

In short, it affects everything.

To understand its customers better, a business must ask the following questions:

- What are the customer’s core business goals? Are they achieving them?

- What are the most important issues in the industry currently?

- What are the customer’s top business issues and concerns?

- What products or services will help them deal with the issues and concerns?

- Are the customer’s business needs met? If not, what are the gaps?

Uncovering and defining the customers’ needs is a cornerstone of good GTM decision-making.

2. The customer experience

Customer experience involves determining what kind of relationship a customer wants to have with their vendors, and whether they want a ‘relationship’ at all.

Accordingly, a business can choose its mix of channels, messaging, and strategies to meet the expectations. Broadly, three kinds of customer experience exist:

- The efficient, low-cost transactional experience: These are the kind of customers who want to do business efficiently and easily, without much face-to-face support.

- The high-touch, consultative experience: These are the customers who have strong preferences and demands for ‘high-touch’ relationships involving consultation and advice, frequent face-to-face interaction, and a more complete range of services.

- The flexible, multi-access point experience: This is an approach where customers have the ability to choose from flexible, multichannel experience that allows them to do business on their own terms, inexpensively, and efficiently.

An extension of the multi-access point is omnichannel which takes into account that the customer journey may span multiple channels and looks at how to create the best experience as consumers move between them.

Businesses can better understand what kind of ‘customer experience’ their target customers seek by asking the following questions:

- What are the customer’s most important factors when purchasing goods or a service?

- What do they look for in their vendors?

- Which vendors currently provide the best mix of products, services, channels, and support? What is specifically good about their approach?

- What parameters other than price does the customer value?

- Would the customer like a single solid channel or prefer multiple channels to do business?

- How important is a face-to-face (F2F) relationship? Is the customer willing to do away with F2F for a 5-10% price reduction?

With a fair idea of what experience a customer is looking for, businesses can proceed with the next question – buying behaviors.

3. Customer buying behavior

A Customer’s buying behavior is crucial as it decides how to transact the business.

Off-base assumptions about customer buying behavior can lead to companies investing billions of dollars in building channels that no one wants, such as websites that no one visits or call centers that no one calls.

Understanding customer behavior involves three steps:

- Investigating what channels customers use today

- Assess where their buying behavior is headed in the future

- Combine the results of current and future channel behavior to uncover trends

For example, in the table below, the second column indicates the analysis of current customer behavior, the third indicates the future and the last column shows the change in trend:

| Present behavior (% of times used) | Future behavior (% of times ‘will-use’) | Channel shift (growth in %) | |

|---|---|---|---|

| Field Sales Reps | 67 | 62 | -7 |

| Distributors | 42 | 52 | +24 |

| Ordering from Catalog | 24 | 32 | +33 |

| Tele-sales | 7 | 11 | +57 |

| Retail sales | 16 | 27 | +69 |

| Fax order | 14 | 23 | +64 |

| Internet | 5 | 16 | +220 |

From the example case, the following can be easily inferred:

- Customers believe they will substantially increase Internet usage (over 200%).

- Growth in Internet purchasing will far exceed the anticipated growth of any other channel.

- Customers anticipate increasing their purchasing activity through most channels indicating a migration towards multi-channel purchasing.

4. Strengths and weaknesses

This is an assessment of a business’s own strengths and weaknesses as perceived by its customers. This can be uncovered using a gap analysis involving in-depth qualitative conversations with key trusted customers who are open and honest.

5. Sources of new business

Businesses must periodically ask their customers – ‘What would cause you to do a lot more business with us?’. Including this simple question in every customer analysis, at the very least, generates new sales but can do a lot more, in terms of helping to understand what customers want.

Tools for gathering customer information efficiently

The below table indicates five tools commonly used to gather customer information and their advantages/disadvantages:

| Advantages | Disadvantages | |

|---|---|---|

| Written customer surveys | Useful for collecting simple, quantifiable information. Ex: Ratings & Rankings Mostly suitable for B2C. | Not suitable for complex questions or B2B interactions. Customers will not take time to provide long answers. |

| Face-to-face interviews (F2F) | Ideal tool for building a customer fact-base. Aligns well with B2B sales and complex issues that characterize most GTM strategy efforts | Time-consuming and expensive. Impractical to collect information beyond a small number of key customers. |

| Focus groups | A powerful tool for conducting observation and analysis. Enables higher ‘throughput’ when compared to F2F interviewing. Reveals how customers interact with each other as they evaluate the product. | Logistically complex and takes time to organize. Difficult to organize when the customer base is geographically diverse. Expensive compared to other options. Not suited to uncover intangible issues such as channel preferences, general positioning, and messaging. |

| Telephone interviewing | Permits in-depth, confidential exploration compared to focus group. Suitable for large, geographically dispersed customer base. Most GTM questions can be asked over the phone. Can be automated using software. | Respondents may not answer the call and can hang up at any time Cannot use any visual aids to assist Not suitable where a physical product must be viewed or handled. |

| The Internet | Credible, low-cost replacement for traditional written surveys. Powerful when used as a research and alignment tool. Helpful in gathering advice and feedback early in the product development cycle. | Cannot replace F2F in drill-down analysis of customers’ deep-seated needs. Not all customers are on the internet. |

In the end, the cornerstone of a winning GTM strategy is to understand the fundamental needs and buying behaviors of target customers with enough precision to make high-reward yet high-risk go-to-market decisions.

Choosing the right channels and partners

A channel is any pipe that a business uses to connect its products and services with its target customers. It enables information to flow both ways between buyer and seller, thus making sales transactions possible.

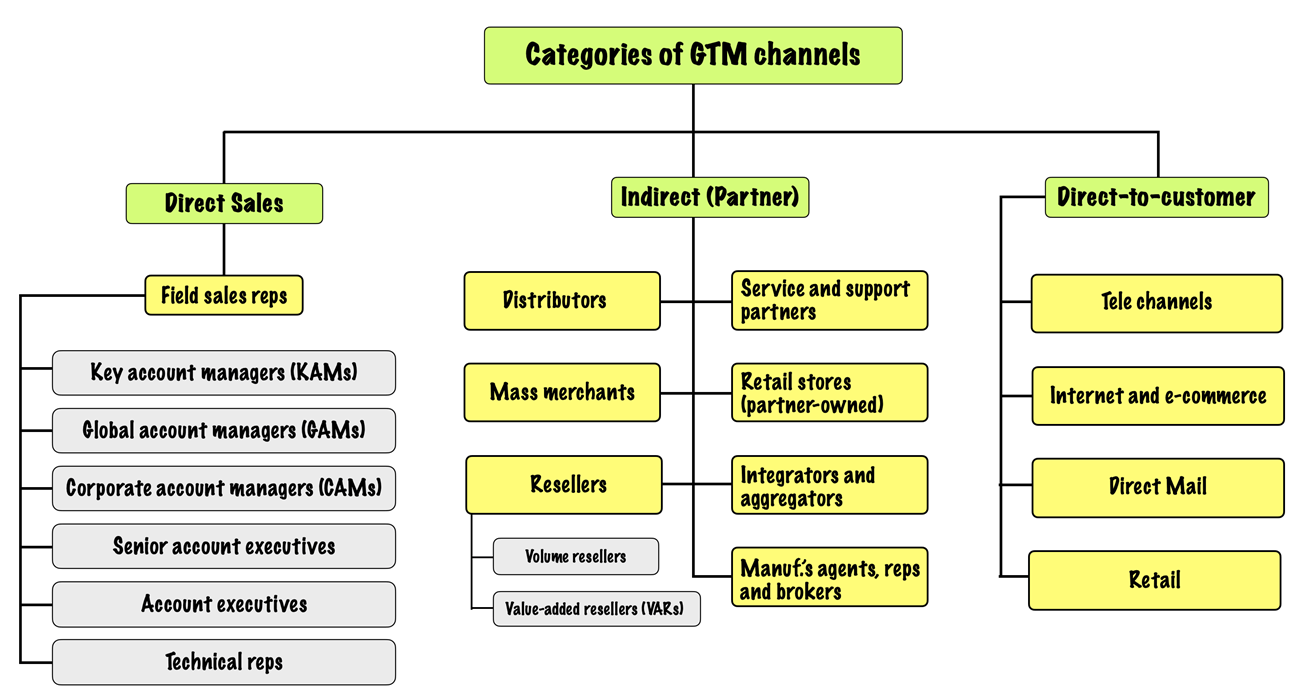

Channels provide valuable feedback and are sources of competitive advantage. They fall under three categories:

The Direct Sales channel

The direct channel, or field sales force, is a company-owned, company-paid channel that sells products and services directly to end customers.

Such a channel is ideal when:

- The product or service is complex in nature

- The business wants to retain control over the sales process in key accounts

- The customer expects ‘high-touch’ service.

Despite their obvious capabilities in high-end sales, they have disadvantages such as higher costs to maintain a salesforce and an inability to cover and penetrate the broader marketplace.

Businesses must use direct sales channels only to acquire large strategic accounts and make complex, big-ticket sales while leveraging other channels to handle smaller deals and less strategic accounts.

Indirect Channels (business partners)

An indirect channel involves an intermediary that sits between the business and the end customer. These kinds of channels are suited for lower-cost sales requiring local customer support and vertical market reach across expanded geographic regions.

The intermediary could be manufacturers’ reps, agents, brokers, resellers, local, national, and global distributors, consultants, integrators and a variety of industry-specific partner types.

Such channels are better suited when products and services require customization, configuration, installation, support, and guidance in the sales process.

This is also the only kind of channel in which business partners can sometimes combine a company’s offerings with those of other companies to create complete solutions.

Direct-To-Customer channels

In a Direct-to-Customer (D2C) channel, a business sells directly to end customers without deploying a field sales force.

With the rise of e-commerce and online retail, D2C has emerged as the most favored approach for businesses.

The proportion of consumers worldwide who regularly make direct-to-consumer (D2C) e-commerce purchases has increased significantly in recent years. For example, in 2022, D2C e-commerce purchases held a 64 per cent share.[5]

For businesses, D2C brings several benefits, such as:

- Low capital requirements which makes it ideal for testing early-stage product-market-fit

- Access to a rich stream of customer data and insights that help align better

- Ability to reach markets efficiently regardless of how geographically dispersed they are

- A convenient, low-cost, hassle-less way of buying for customers without any sales pressure

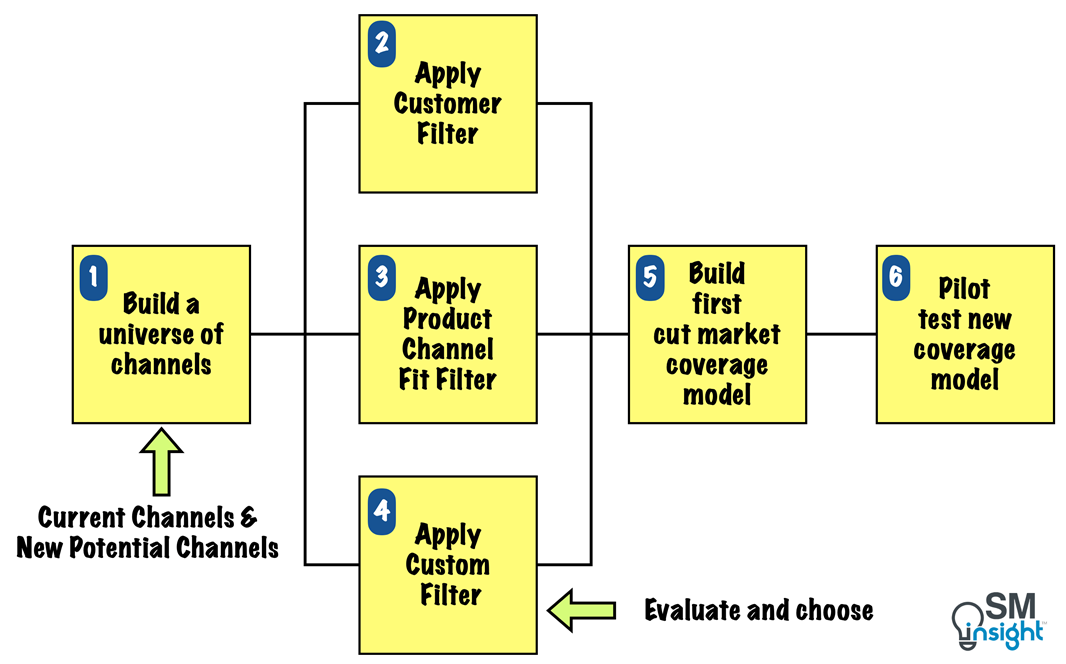

Selecting channels and partners – The six-step process

Businesses can make use of a six-step process to select the right channels and partners as shown:

1. Build a Universe of Channels

The process of building a Universe of Channels involves three steps:

The first is to identify all the channels that are currently used for lead generation, sales, support, service, and account management.

The Second involves identifying all channels used by direct competitors, as well as vendors and partners participating in the target markets. The following questions can be used to explore more about competitor and vendor channels:

- Which channels are competitors using today?

- What do they use those channels for?

- Who do they use those channels to serve (all or certain customers)?

- How well are their channels working?

- What new channels are they now building or considering for the future?

The Third step requires a more creative and out-of-the-box approach that involves discovering new channels that could be used to connect with target customers.

Once the Universe of Channels is ready, the next step is to apply filters.

2. Applying customer filter to channels

The Goal of applying a customer filter is to meet the customer’s ‘when’, ‘where’ and ‘how’ they want to do business. There are two tools that can be used to access the right channels:

The First is to eliminate channels that align poorly with the customers’ needs and focus on those that do.

The table below is an example of how channel capabilities compare with the needs of the customer. It serves as a useful tool to eliminate channels that are not aligned:

| Customer Need ↓ | ← Channel type → | ||||||

| Field sales force | Value-add partners | Vol Reseller Distributor | Retail/mass merchants | Call centers | Direct mail | Internet | |

| Expert advice / ‘hand-holding’ | ✔ ✔ ✔ | ✔ ✔ ✔ | ✔ | ✔ ✔ | ✔ ✔ | ✔ | ✔ |

| Training | ✔ ✔ ✔ | ✔ ✔ ✔ | ✔ ✔ | ✔ | ✔ | ✔ | ✔ |

| Customization | ✔ ✔ ✔ | ✔ ✔ ✔ | ✔ | ✔ | ✔ | ✔ | ✔ ✔ |

| Integrated ‘total solution’ | ✔ ✔ | ✔ ✔ ✔ | ✔ ✔ | ✔ | ✔ | ✔ | ✔ |

| On-site set-up & installation | ✔ ✔ ✔ | ✔ ✔ ✔ | ✔ ✔ | ✔ ✔ | ✔ | ✔ | ✔ |

| Self-service, independence | ✔ | ✔ | ✔ | ✔ ✔ ✔ | ✔ ✔ | ✔ ✔ ✔ | ✔ ✔ ✔ |

| Low prices | ✔ | ✔ ✔ | ✔ ✔ | ✔ ✔ | ✔ ✔ ✔ | ✔ ✔ ✔ | ✔ ✔ ✔ |

| Fast local support | ✔ ✔ | ✔ ✔ ✔ | ✔ ✔ | ✔ ✔ | ✔ | ✔ | ✔ |

| 24 7 support | ✔ | ✔ ✔ | ✔ | ✔ | ✔ ✔ ✔ | ✔ | ✔ ✔ ✔ |

| ✔✔✔: Excellent channel choice ✔✔: Good channel choice ✔: Marginal/poor channel choice. | |||||||

The second tool provides a more exact approach. It involves identifying channels that customers are already using to buy similar products and services. Channel behavior analysis (discussed earlier in customer buying behavior) can be performed to identify such channels.

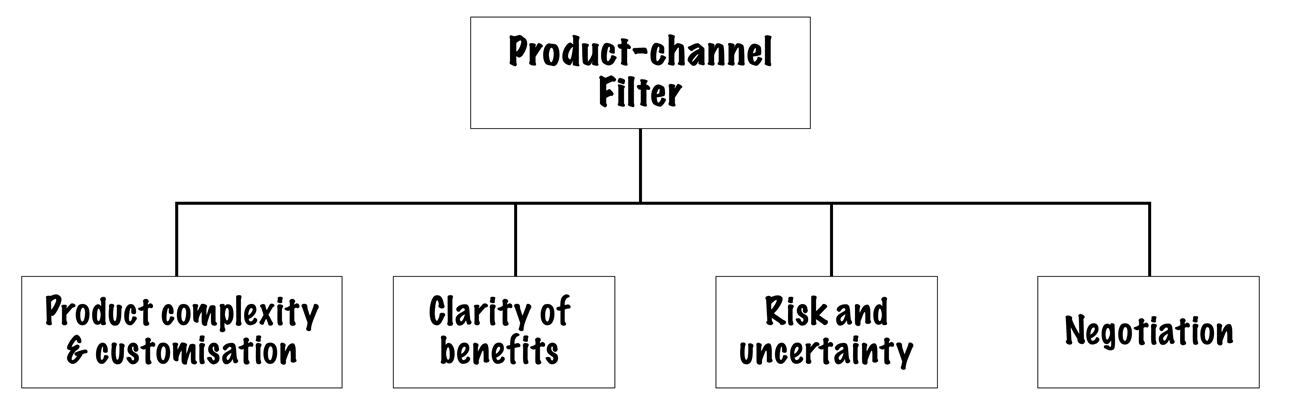

3. Apply product–channel fit filter

The product-channel filter is based on a simple rule that what is sold has to fit with how it is sold. There are four effective ways to evaluate product–channel fit:

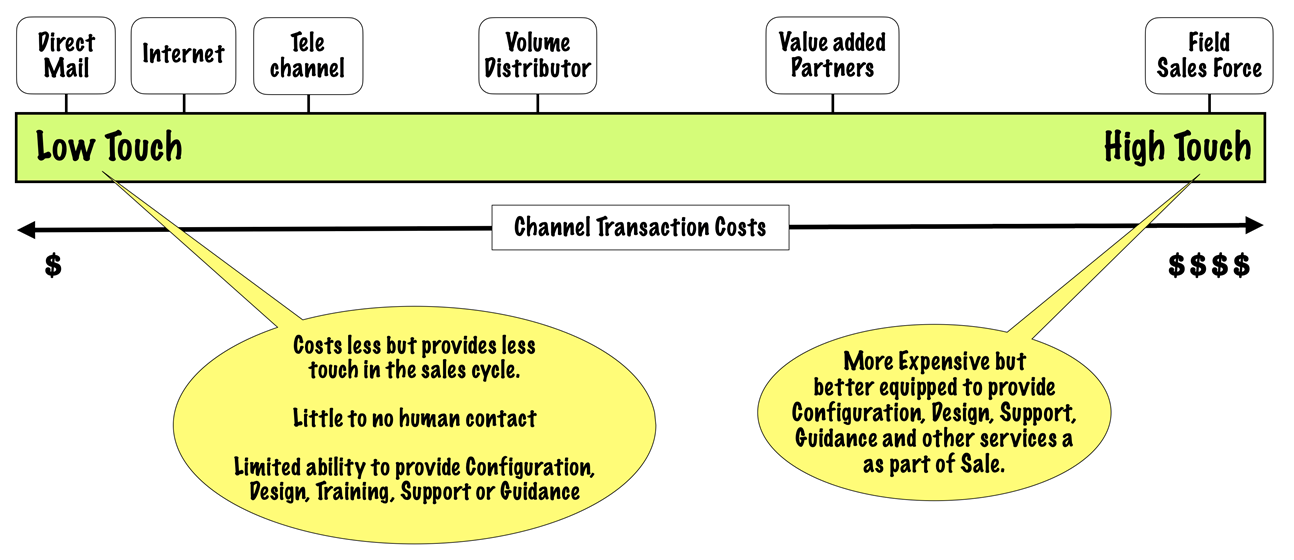

First is product complexity and customization. Complex, highly customized products require extensive configuration, design, training, support, and advice in the sales process. As a result ‘high-touch’ channels are better suited for such products.

Conversely, simpler products that require little, if any, customization, training, support, or advice are suited for ‘low-touch’ channels, which can reach more customers at a lower cost.

The below figure suggests how channels line up in terms of the amount of ‘touch’ that they provide in the sales process:

Second is the Clarity of benefits.

Some products sell themselves. Their benefits are obvious and the problems they solve are easily recognizable. Such products seldom need face-to-face interaction or convincing customers of their utility.

Conversely, many products have unclear or difficult-to-articulate benefits. This could be because the product is new or too complex to explain quickly and easily.

For example, selling customer relationship management software will require a proper understanding of customer’s needs and goals before its benefits can be assessed.

The choice of channel thus depends on which of the above products is sold.

Risk and uncertainty is the third factor.

Customers are unlikely to buy products and services through an impersonal channel where the potential risk or financial implications are high. A high-touch channel is the natural choice for such channels. (Example: High-value equipment purchase, industrial machinery)

The fourth factor is Negotiation.

Products that have fixed prices, standard terms and conditions, and no room for negotiation go well with low-touch channels. Conversely, more expensive offerings such as cars and houses, involve intensive negotiation as part of the sales process.

While the internet has, to an extent, enabled such interactions through auction sites and e-marketplaces, serious negotiations are still conducted face-to-face.

The selected channels must fit well with the negotiation requirements of products and services. Complex, risky, or negotiated offerings require higher-touch channels.

4. Apply ‘custom’ filters

The goal of this step is to assess the universe of channels against the organization’s unique goals or requirements.

The most commonly used filters in this step are profitability and time-to-market.

Depending on the importance of profitability, a channel’s cost-to-serve becomes an essential part of the channel evaluation process. Similarly, companies that target to sell more products and services quickly must prioritize channels that can be quickly assembled.

5. Build a ‘first cut’ market coverage model

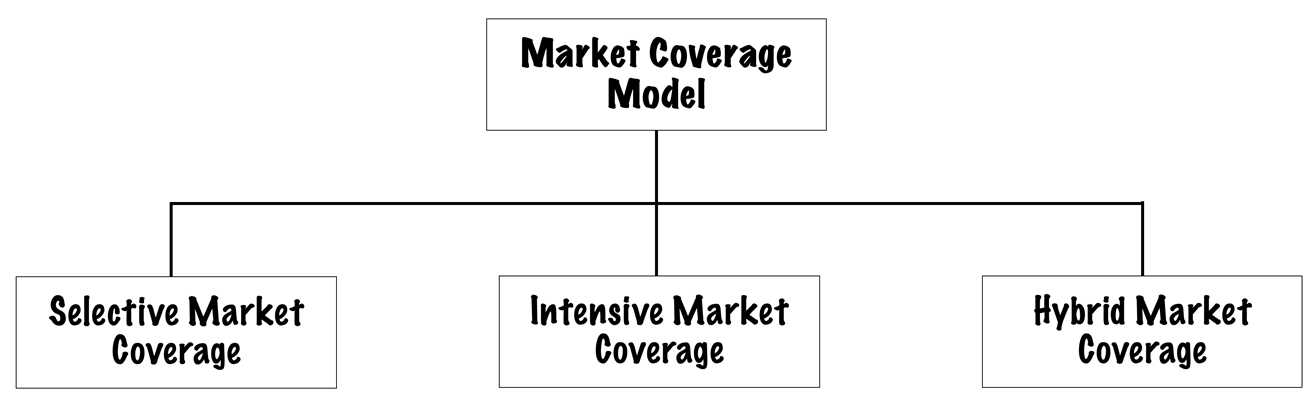

A market coverage model answers which channels will sell which products to which customers. Primarily, they could be developed in three ways:

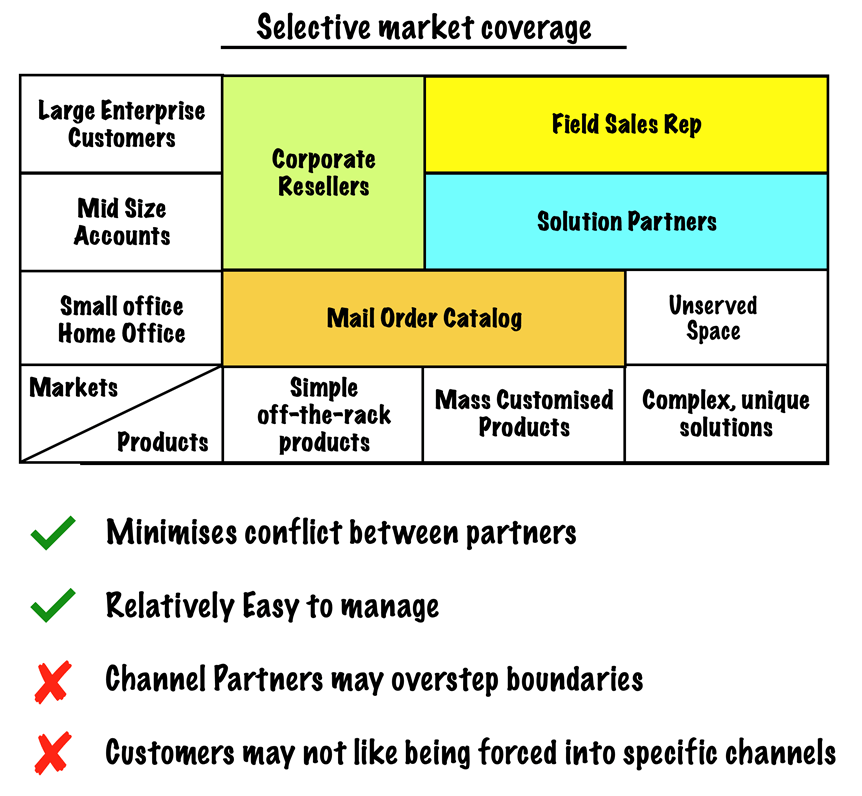

In a Selective market coverage approach, each of the different sales channels is assigned to discrete markets and segments, thus minimizing (or eliminating) overlap between channels as they pursue sales opportunities.

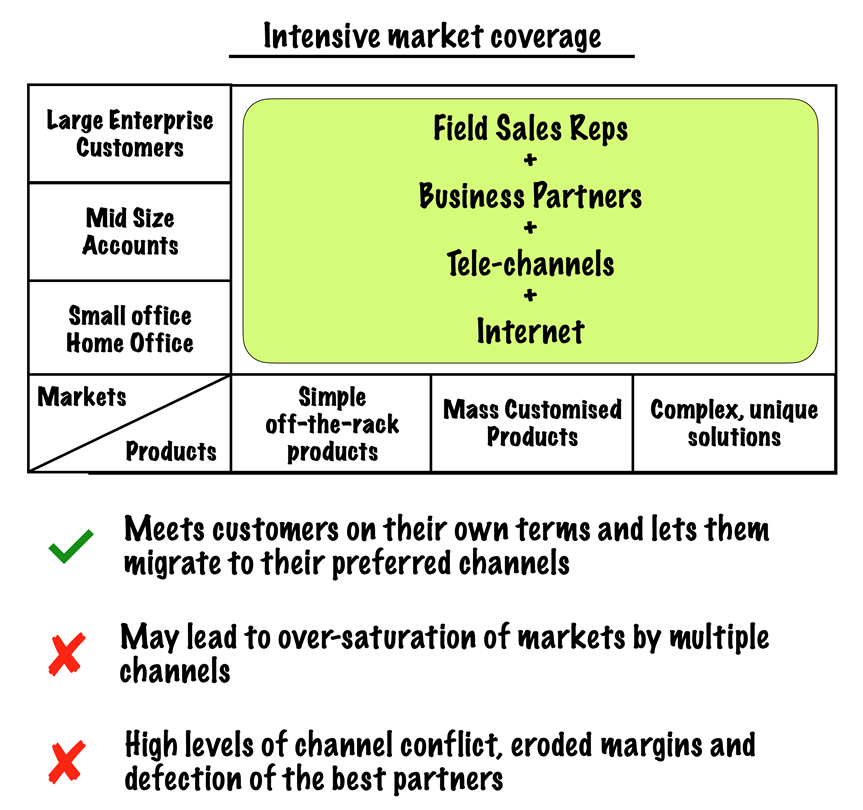

In intensive market coverage, all channels sell most or all products to all customers. It is a ‘maximum flexibility’ model, designed to let all customers do business however they want, whenever they want, wherever they want.

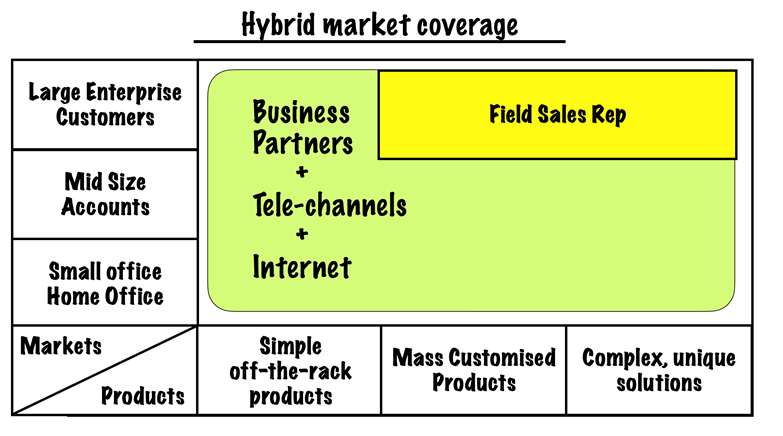

A mix of both is the hybrid market coverage model where a core, select group of premium customers are provided with high-touch, premium channels, while the remainder of the market is offered a convenient but lower cost, multiple-channel mix.

6. Pilot-testing the market coverage model

Despite the best efforts to anticipate and avoid potential issues, either of these channels may meet with customer resistance or even outright rejection.

To avoid the risk of failure after making large commitments and investments, market coverage models must undergo pilot testing.

This involves a carefully controlled test run in a managed, low-risk environment. Pilot test parameters are selected based on three principles:

- Representative, but low-risk, markets: These are geographical or industry/vertical markets that are representative of the target markets, yet non-critical.

For example, if a business sells mostly to manufacturing customers, then a manufacturing segment is the appropriate place for a pilot test. - One or two new channels: A pilot test should consist, at most one indirect channel and one direct-to-customer channel. For example, a business might introduce a call center to create new leads (telemarketing), while adding in some local value-added resellers.

Introducing too many channels in pilot testing makes it difficult to correlate the sales with the performance of each channel. - Results Monitoring:Key performance indicators (KPIs) must be carefully monitored both before and after the pilot test. This provides the certainty required to take a new coverage model to a broader base of customers.

The product and the value proposition

Creation or change in the GTM strategy necessitates a careful re-evaluation of offerings and value propositions to ensure they fit with the updated markets, customers, and channels.

Impact of market and customer change

New customers can have different needs, expectations, and requirements. This requires a reassessment of products and whether they are truly ready and appropriate for the target customers. At a very minimum, the following should be considered:

- Features and functions – Are the offerings meeting the needs of new customers?

- Price – Do new customers have the same budgets and financial constraints?

- Support requirements – Are the expectations and demands related to product support the same for new customers?

Corning[6] – the world leader in glass, ceramics and industrial material manufacturing is a classic example of a company with an evolving product and value proposition. The company’s business strategy focuses on selling key components that significantly improve its customers’ complex products.

In line with the changing needs of its customers, Corning transitioned from mass-producing glass for light bulbs to durable cookware lines to cutting-edge optical fibres that powered internet telecommunication.

With the smartphone revolution, the company even produced the hard-to-break Gorilla Glass that is today used in flagship devices like Apple iPhone, iPad and Watch.[6]

The impact of channel change

Changes to a channel mix can have dramatic implications on product offerings particularly when migrating to lower-cost D2C channels.

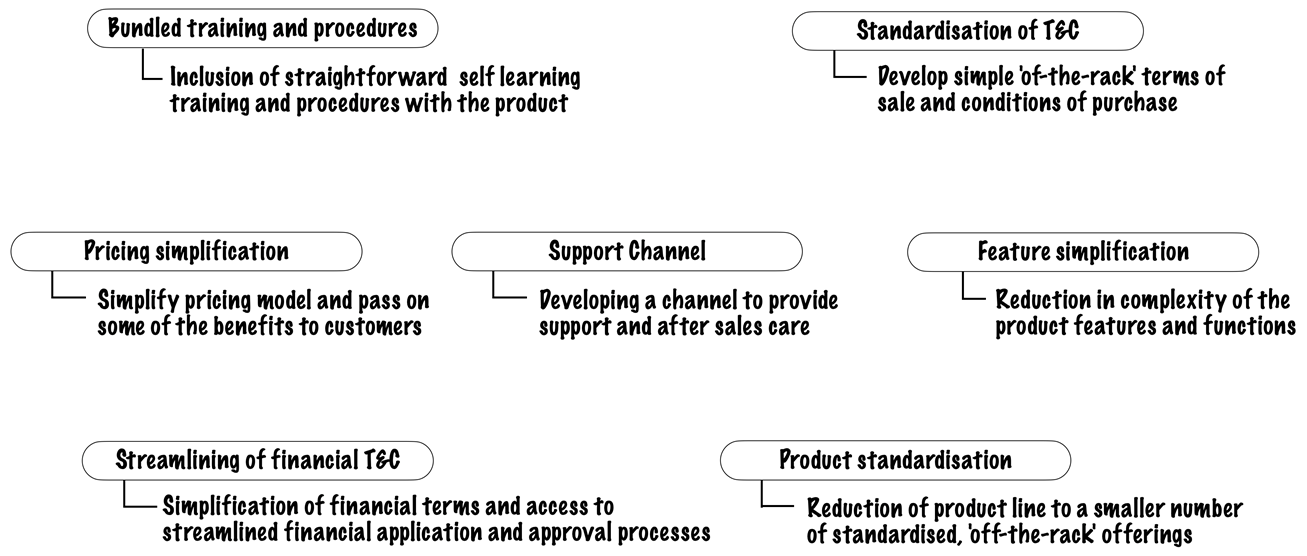

If the GTM objective is to make more or better use of low-cost channels, products need to be rethought and redesigned to work with the new channel mix. The following strategies can be utilized to align product-channel fit:

A winning value proposition

For success, the right product must be combined with a winning value proposition, a core message that compels customer interest and purchasing activity.

Confusing, fuzzy messages do not generate sales. A product’s value proposition should be a tight, crisp message that, regardless of the media through which it is promoted, contributes to tangible sales success.

A winning value proposition must have four characteristics:

- Simplicity – must be clear and concise, to the point, and easy for customers to understand. In a few sentences, it must convey the basic value that the product or solution offers.

- Compelling – Must explain why one should be interested in buying. In most cases, communicating value in terms of real numbers and financial terms works best.

- Believable – Must have claims that are realistic, honest, and believable. Having detailed customer reference cases to back up the claim helps.

- Attractive to the right customers – A value proposition must be targeted at the right customers, specifically, the customers that a business is attempting to acquire.

In summary, a good GTM strategy is a serious and real source of competitive advantage. In a market where customers expect and demand better ways of doing business, new GTM models will keep emerging.

Companies that put great effort into their abilities to go to market faster, better, cheaper, and more effectively than the competition will emerge as market leaders with GTM strategy playing a crucial role in their success.

Sources

1. “Go To Market Strategy: Advanced Techniques and Tools for Selling More Products, to More Customers, More Profitably”. Lawrence Friedman, https://www.amazon.com/dp/0750674601. Accessed 03 Sep 2023

2. “Segway”. Wikipedia, https://en.wikipedia.org/wiki/Segway. Accessed 03 Sep 2023

3. “The Reason The Segway Was A Massive Failure Read More”. Slashgear, https://www.slashgear.com/852463/the-reason-the-segway-was-a-massive-failure/,. Accessed 03 Sep 2023

4. “Tata Nano”. Wikipedia, https://en.wikipedia.org/wiki/Tata_Nano. Accessed 03 Sep 2023

5. “Share of consumers who regularly make direct-to-consumer (D2C) purchases from brands worldwide in 2019 and 2022”. Statista, https://www.statista.com/forecasts/1346429/consumers-buying-d2c-worldwide. Accessed 06 Sep 2023

6. “Our Company”. Corning, https://www.corning.com/worldwide/en/about-us/company-profile.html. Accessed 06 Sep 2023

7. “10 Hugely Successful Companies that Reinvented Their Business”. U.S. Chamber of Commerce, https://www.uschamber.com/co/good-company/growth-studio/successful-companies-that-reinvented-their-business. Accessed 06 Sep 2023